Treasuries Are Best Described as the Federal Government's Debt Instruments

STIP VTIP and PBTP are the best Treasury ETFs for Q2 2022. Is responsible for monetary policymoney supply.

The opinion statement issued by GAO is also included.

. Treasury and backed by the US. By Wolf Richter Wolf Street. Over the past week and a.

Estimates suggest that the size of its balance sheetie the number of bonds it has boughtcould double or almost triple over the course of the year. Helps people in need. The model captures the dynamic interactions between economic conditions budget deficits.

Debt instruments of state governments exempt from federal taxes certificates of loans or promises from a borrower to a lender to repay principal and interest accrued. Schedules of Federal Debt - Annual Audited. The datasets listed below only include debt issued by the Treasury Department.

As bond prices rise people holding bonds are more tempted to hold them. Which definition best describes the process of zero-based budgeting ZBB. Keeps the country out of debt.

This paper describes a model that can be used to inform debt management choices facing the US. During which of the following administrations did the US. Which of the following best describes a money market security.

Below are the Schedules of Federal Debt and the accompanying notes as audited by the Government Accountability Office GAO going back to 1997. A Treasury Bill T-Bill is a short-term debt obligation issued by the US. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agenciesThe terms national deficit and national surplus usually refer to the federal.

In face of the incredibly spiking US gross national debt that just hit 30 trillion after having spiked by a mind-boggling 65 trillion since March 2020 the steamy-hot question is this. B Bonds are tendered for equity securities. Arbitrage is the simultaneous.

TPDO is the sum of Debt Held by the Public and Intragovernmental Intragov Holdings. A debt instrument or security with a high default risk and a low liquidity. In owning them.

Treasury yields edged higher on Wednesday with the yield curve close to its flattest level in a decade in advance of a 23 billion auction of 10-year government securities the second part of the 64 billion quarterly refunding this week. Government with a maturity of less than one year. Who sets monetary policy in the United States.

To meet this objective we issue debt in a regular and predictable manner provide transparency in our decision-making and seek continuous improvements in the auction process. Federal Reserve has said it could buy unlimited quantities of US. In addition the Federal Reserve is also buying new types of assets in new ways.

Treasury bills notes and bonds. D New bonds are sold and the proceeds used to redeem old bonds. Some datasets include debt issued by the Federal Financing Bank FFB.

None of the above 2. Conversion is best described by. By acting soon the federal government can preserve a public debt market through purchases ofassets in excess ofwhat is required to soak up present surpluses.

Some of the most common. Treasury bonds are a type of capital market instrument. Debt security instruments are complex advanced debt instruments structured for issuance to multiple investors.

Investments in foreign countries True or False. It is a low-cost investment mechanism that enables businesses banks and the government to meet immense but short-term capital requirements at a reasonable cost. He is an expert on company news market news political news.

For companies seeking financing the higher the price of bonds the more attractive it is to sell bonds. 2019 and 2020. Schedules of Federal Debt.

NEW YORK Nov 8 Reuters - US. Ashort-term debt obligation bissued by the US. A debt instrument or security with a high.

Treasury bonds are long-term debt securities issued by the government with maturities greater than ten years. The capital account balance includes all foreign private and government investment in the United States netted against US. The question is particularly hot because Treasuries are now ugly instruments with the worst punishment yields ever.

Memorize flashcards and build a practice test to quiz yourself before your exam. Only the Annual schedules are audited by GAO. The Treasury Departments primary goal in debt management policy is to finance the government at the lowest cost over time.

T-Bonds is the official term for a. In creating and executing our financing plans we must contend with various. C Bonds are paid off by a corporation prior to maturity.

The bond supply curve slopes upward because. Which of these best describes the US. Start studying the Finance Midterm flashcards containing study terms like True or False.

Federal government eliminate long-standing budget deficits and begin running budget surpluses. In lieu of an increased need to finance the federal budget with Treasury issues the Federal Reserve will be faced with the dilemma ofhow to implement Monetary Policy. The national debt is best described as.

As bond prices rise people demand more bonds. As bond prices rise yields increase. Who the heck is buying.

The list below provides information on where there are differences in debt calculations related to the national debt. Federal Government cit is useful when imbalances exist between tax revenue and government expenditures dlong-term debt obligation. None of the above 3.

STIP VTIP and PBTP are the best Treasury ETFs for Q2 2022. A New bonds are exchanged for old bonds. Matthew Johnston has more than 5 years writing content for Investopedia.

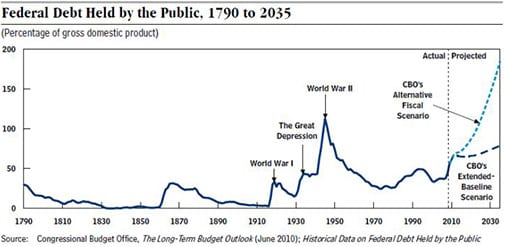

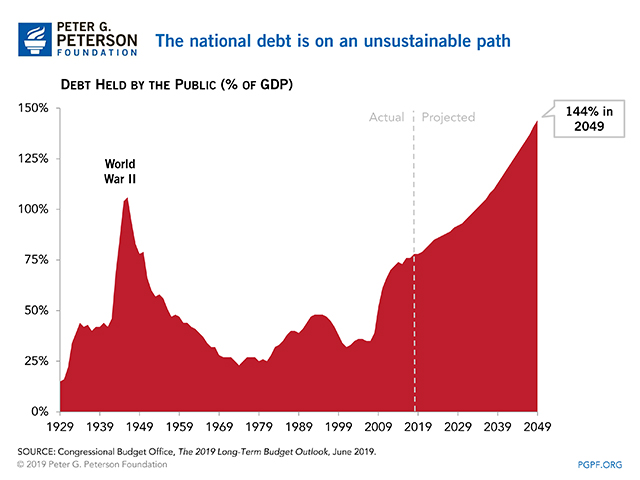

Federal Debt A Primer Congressional Budget Office

Us Government Debt Of Gdp 1969 2022 Ceic Data

How Is The National Debt Measured Uptous

How Will We Pay Back The Federal Debt Econofact

Anglo Saxon Central Banks Are Taking All The Risk Free Assets Asset Freak Out The Expanse

Federal Debt Trends Over Time U S Treasury Data Lab

Aaj Ka Gyan One Month Effect Of Idbi Bank Stock Price Stock Price Idbi Bank Stock Market Stock Prices

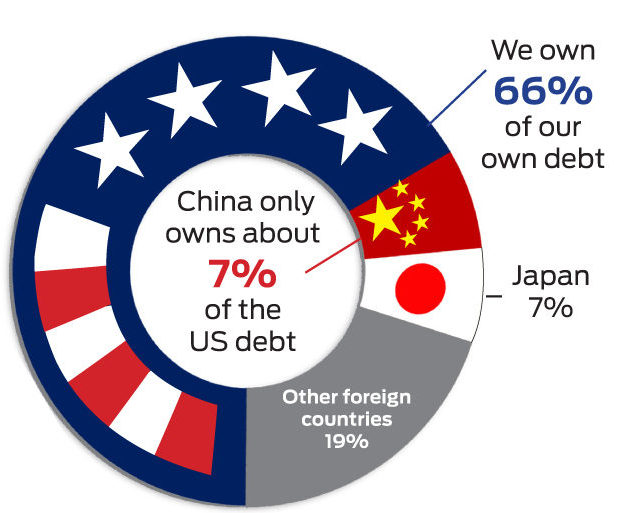

Trade Facts China S Ownership Of Us Federal Debt China Business Review

Stillness In The Storm Strawman Accounting Redemption How To Fix Credit

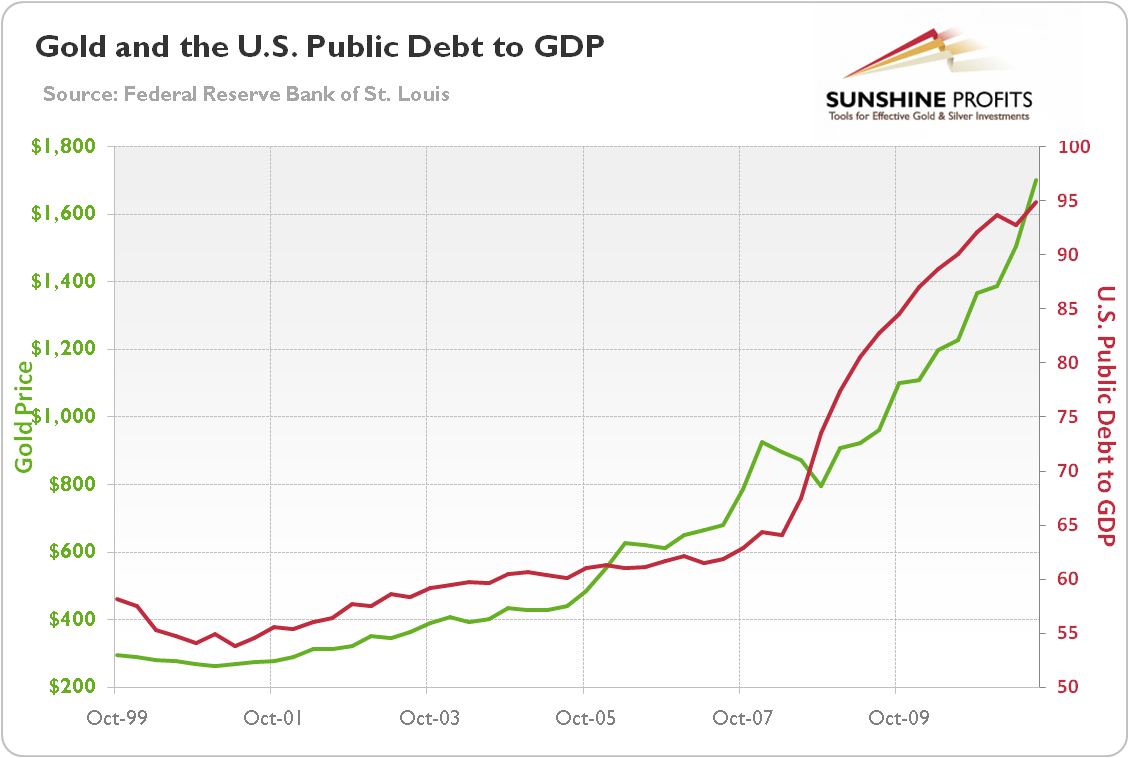

Federal Debt And Gold Implications Sunshine Profits

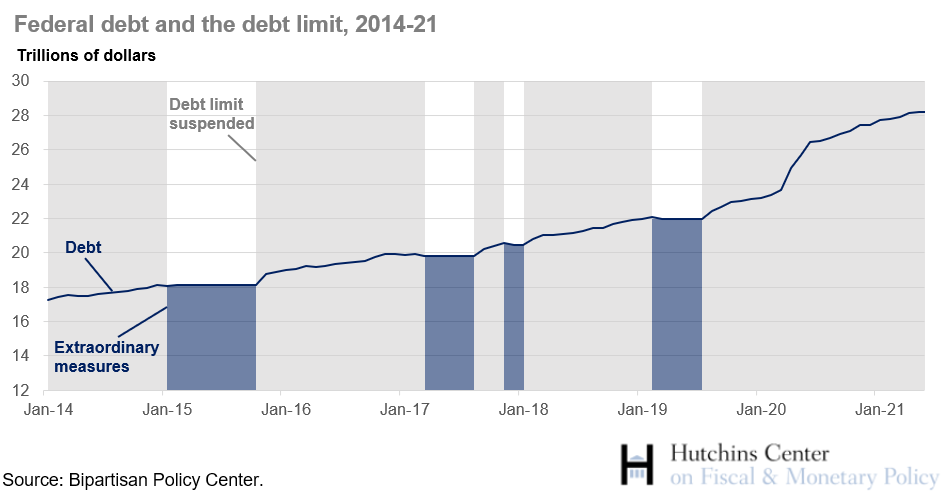

What Is The Federal Debt Ceiling

Treasury Bonds Are Riskier Than You Think Here S Why

Federal Debt A Heavy Load Kiplinger

Federal Debt A Primer Congressional Budget Office